Within 24.51m of 486.30 g/t AgEq

Silver47 Exploration Corp. (TSXV: AGA) (‘Silver47’ or the ‘Company), is pleased to announce the first results from the 2024 drill program at the Company’s wholly-owned flagship Red Mountain Project in Alaska, USA. The results for the first of 6 holes drilled on the property in 2024 indicate strong potential for increased high-grade infill drilling within the Dry Creek resource area. A total of 1,039 metres of drilling was completed in 6 holes at the Dry Creek, West Tundra Flats, and Kiwi prospects combined.

Highlights from hole DC24-106:

- Drilling cut several massive sulphide horizons within a 24.5m semi-massive mineralized section at the Dry Creek Zone with the highest gold grade interval intercepted to date on the project and remains open

- From a depth of 128.29m, hole 106 cut 2.48 m of 61.44% ZnEq or 2,938.5 g/t AgEq(14.95 g/t gold 249.50 g/t silver, 21.97% zinc, 7.03% lead, 0.42% copper)

- From a depth of 133.87m, hole 106 cut 0.91 m of 46.74% ZnEq or 2,235 g/t AgEq(8.08 g/t gold, 225.00 g/t silver, 21.20% zinc, 6.68% lead, 0.42% copper)

- From 126.40 m-150.91m a 24.51 m interval graded 10.17% ZnEq or 486.3 g/t AgEq(1.99 g/t gold, 55.50 g/t silver, 4.08% zinc 1.32% lead, 0.10% copper)

Mr. Alex Walls, P.Geo., Vice President of Exploration, stated: ‘We are extremely excited to report these kinds of high-grade polymetallic intercepts in our first drill program on the Project. This drill intercept supports our thesis that Red Mountain Project hosts significant precious metal enrichment in addition to the base metal endowment.’

Dry Creek Target Area

The Dry Creek mineralization consists of multiple horizons of semi-massive to massive sulfides within the metavolcanics and metasediments of the Totatlanika Schist which can be traced for 4,500m and dips steeply to the north. The Fosters and Discovery lenses of VMS mineralization make up the central 1,400m of the Dry Creek North Horizon occurring as massive to semi-massive silver-zinc-lead-gold-copper sulfides. The lenses pinch and swell along strike and down-dip, as is typical of VMS deposits. True width intersections are up to 40 m at Fosters where there is evidence of growth faults, showing potential proximity to a VMS feeder zone.

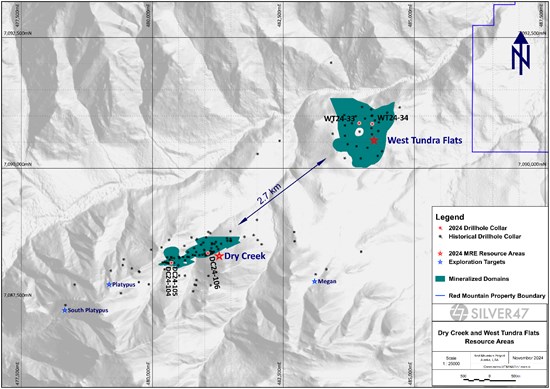

Figure 1. Plan map of drill holes at Dry Creek and West Tundra Flats resource areas.

To view an enhanced version of this graphic, please visit:https://images.newsfilecorp.com/files/10967/230387_a4dd4a86f4a1fbb3_002full.jpg

Table 1. Significant intervals for hole DC24-106, Dry Creek Zone, Red Mountain Project.

| Hole | From | To | Interval | ZnEq | AgEq | Au | Ag | Zn | Cu | Pb |

| ID | (m) | (m) | (m) | (%) | (ppm) | (ppm) | (ppm) | % | % | % |

| DC24-106 | 126.40 | 150.91 | 24.51 | 10.17 | 486.3 | 1.99 | 55.5 | 4.08 | 0.10 | 1.32 |

| incl. | 128.29 | 130.77 | 2.48 | 61.44 | 2938.5 | 14.95 | 249.5 | 21.97 | 0.42 | 7.03 |

| and | 133.87 | 134.78 | 0.91 | 46.74 | 2235.0 | 8.08 | 225.0 | 21.20 | 0.42 | 6.68 |

| and | 145.94 | 150.91 | 4.97 | 4.33 | 207.4 | 0.26 | 68.7 | 1.84 | 0.04 | 0.73 |

Assay intervals are weighted average and are drilled lengths, true widths cannot be determined at this time.

Notes:

- g/t=grams per tonne; AgEq=silver equivalent; ZnEq=zinc equivalent; m=metres; Ag=silver; Au=gold; Cu=copper; Zn=zinc; Pb=lead; 1ppm=1 g/t

- Equivalencies are calculated using ratios with metal prices of US$2,750/tonne Zn, US$2,100/tonne Pb, US$8,880/tonne Cu, US$1,850/oz Au, and US$23/oz Ag and

- Metal recoveries are based on metallurgical work returned of 90% Zn, 75% Pb, 70% Cu, 70% Ag, and 80% Au.

- Zinc Equivalent (ZnEq %) = [Zn (%) x 1] + [Pb (%) x 0.6364] + [Cu (%) x 2.4889] + [Ag (ppm) x 0.0209] + [Au (ppm) x 1.923]

- Silver Equivalent (AgEq g/t) = [Zn (%) x 47.81] + [Pb (%) x 30.43] + [Cu (%) x 119] + [Ag (g/t) x 1] + [Au (g/t) x 91.93]

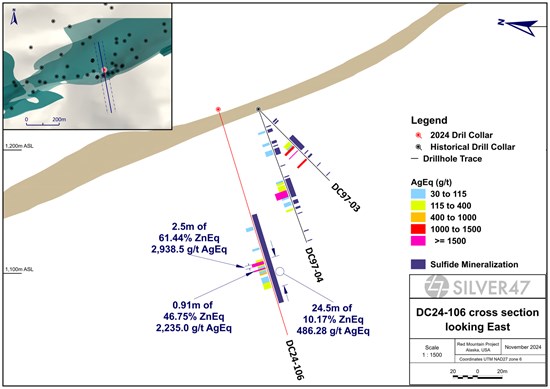

Figure 2. Drill Hole DC24-106 Cross Section.

To view an enhanced version of this graphic, please visit:https://images.newsfilecorp.com/files/10967/230387_a4dd4a86f4a1fbb3_003full.jpg

Technical Discussion on Hole DC24-106

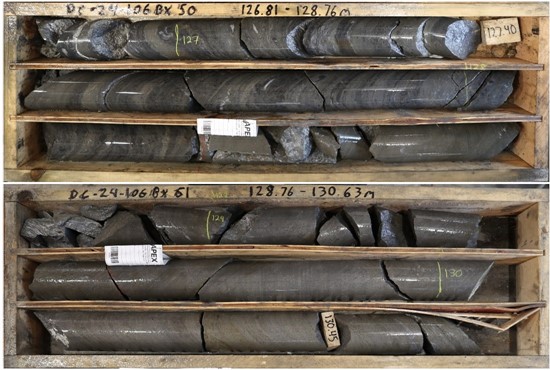

Hole DC24-106 was planned to step 60m down-dip from near-surface mineralized intercepts in DC97-03, DC97-04, DC97-07, and DC97-08. Additionally, the hole was intended to test continuity of high-grade mineralization between the 1997 holes and the deep, down-dip intercept in DC18-79. DC24-106 passes through regionally metamorphosed metasediments and metavolcanics of the Totatlanika Schist. The 24.51m mineralized intercept is hosted in a metarhyolite unit, with increasing intervals of semi-massive sulfides from 126.40m, massive sulfides from 128.3m, and finishing with semi-massive sulfides from 143.45 to 150.91m. The sulfides are comprised of aphanitic to coarse pyrite, sphalerite, galena, and chalcopyrite. The mineralized widths are consistent with the historical results, and the 2.48m of 14.95 g/t gold is the highest-grade gold interval drilled to date on the Red Mountain Project.

Figure 3. Drill Core DC24-106 Photograph at 126.81m – 130.63m Depth.

To view an enhanced version of this graphic, please visit:https://images.newsfilecorp.com/files/10967/230387_silver47fig3.jpg

Figure 4. Drill core DC24-106 photograph of pyrite-sphalerite-chalcopyrite 129.4m-129.5m.

To view an enhanced version of this graphic, please visit:https://images.newsfilecorp.com/files/10967/230387_a4dd4a86f4a1fbb3_006full.jpg

Figure 5. Drill core DC24-106 of pyrite-sphalerite with minor chalcopyrite 134.2m-134.94m

To view an enhanced version of this graphic, please visit:https://images.newsfilecorp.com/files/10967/230387_a4dd4a86f4a1fbb3_007full.jpg

This successful infill hole in the centre of the Dry Creek resource indicates a strong potential for rapid resource upgrade and growth extending down-dip. The wide spacing of the historical drilling provides ample opportunity to increase the resource, which remains open at depth and along strike.

Table 2. 2024 Drill Collar Information, Red Mountain Project.

| Red Mountain 2024 Diamond Drill Hole Collars | ||||||||

| Hole ID | Easting | Northing | Elevation (m) | Azimuth | Dip | Depth (m) | Zone | Status |

| DC24-106 | 481059 | 7088384 | 1233 | 170 | -72 | 192 | Dry Creek | Reported Here |

| DC24-104 | 480364 | 7088200 | 1218 | 180 | -45 | 112 | Dry Creek | Results Pending |

| DC24-105 | 480364 | 7088200 | 1218 | 180 | -75 | 120 | Dry Creek | Results Pending |

| WT24-33 | 483950 | 7090863 | 982 | 0 | -90 | 185 | West Tundra Flats | Results Pending |

| WT24-34 | 484196 | 7090851 | 968 | 38 | -78 | 146 | West Tundra Flats | Results Pending |

| KW24-03 | 470228 | 7085491 | 1561 | 180 | -50 | 283 | Kiwi | Results Pending |

Easting and northing in metres, NAD27 zone 6

About the Red Mountain VMS-SEDEX Project – Alaska, USA

Silver47’s flagship Red Mountain property covers 633 square kilometres of Alaska State-managed land 100km south of Fairbanks, Alaska. The project is well situated for infrastructure, 30km east of the community of Healy which has power, rail and state highway access to Alaska Route 3, providing a valuable connection to Anchorage and tide water. The Company has an approved permit to conduct advanced exploration, including drilling, across the property.

Red Mountain hosts a NI 43-101 inferred mineral resource estimate of 15.6Mt at 7% ZnEq for 1Mt of ZnEq or 335.7 g/t AgEq for 168.6 Moz AgEq at the Dry Creek (DC) and West Tundra Flats (WTF) resource areas as combined open pit and underground. DC and WTF are the two most advanced mineralized zones at Red Mountain, with at least 20 additional mineralized prospects discovered on the property to date over the 60 kilometres of highly prospective geology.

For more information, see the Red Mountain NI 43-101 technical report titled ‘Technical Report on the Red Mountain VMS Property, Bonnifield Mining District, Alaska, USA’ dated January 12, 2024, prepared by Apex Geoscience Ltd., can be found on the Company’s website https://silver47.ca/ and SEDAR+.

Quality Assurance and Quality Control

Quality assurance and quality control (QAQC) protocols for drill core sampling at Red Mountain project followed industry standard practices. Core samples were typically taken at 1.0m intervals in mineralized zones, and 3.0m intervals outside of mineralized zones. Sample lengths were adjusted as necessary so as not to cross lithologic and mineralogic boundaries. QAQC check samples were inserted into the sample stream with one blank, one duplicate (coarse), and one certified reference material (CRM) occurring within every 20 samples. Drill core was cut in half, bagged, sealed and delivered directly to ALS Minerals Fairbanks, Alaska for transport to the ALS Minerals Laboratories labs in North Vancouver, British Columbia. ALS Minerals Laboratories are registered to ISO 9001:2008 and ISO 17025 accreditations for laboratory procedures. Core samples were analyzed at ALS Laboratory facilities in North Vancouver using four-acid digestion with an ICP-MS finish. Gold analysis was by fire assay with atomic absorption finish, or gravimetric finish for over-limit samples. Over-limits for silver, zinc, copper, and lead were analyzed using Ore Grade four-acid digestion. The standards, certified reference materials, were acquired from CDN Resource Laboratories Ltd. of Langley, British Columbia and selected to represent expected mineralization.

Qualified Person

Mr. Alex S. Wallis, P.Geo., is Vice President of Exploration for the Company who is a ‘qualified person’ as defined by National Instrument 43-101. Mr. Wallis has verified the data disclosed in this press release, including the sampling, analytical and test data underlying the technical information and has approved the technical information in this press release.

About Silver47 Exploration Corp.

Silver47 wholly-owns three silver and critical metals (polymetallic) exploration projects in Canada and the US: the Flagship Red Mountain silver-gold-zinc-copper-lead VMS-SEDEX project in southcentral Alaska; the Adams Plateau silver-zinc-copper-gold-lead SEDEX-VMS project in southern British Columbia, and the Michelle silver-lead-zinc-gallium-antimony MVT-SEDEX Project in Yukon Territory. Silver47 Exploration Corporation shares trade on the TSX-V under the ticker symbol AGA. For more information about Silver47, please visit our website at www.silver47.ca.

On Behalf of the Board of DirectorsMr. Gary R. Thompson, Director and CEOinfo@silver47.ca403-870-1166

No securities regulatory authority has either approved or disapproved of the contents of this release. Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS

Information set forth in this news release may involve forward-looking statements under applicable securities laws. Forward-Looking statements are statements that relate to future, not past, events. In this context, forward-looking statements often address expected future business and financial performance, and often contain words such as ‘anticipate’, ‘believe’, ‘plan’, ‘estimate’, ‘expect’, and ‘intend’, statements that an action or event ‘may’, ‘might’, ‘could’, ‘should’, or ‘will’ be taken or occur, including statements relating to the trading of the Company’s common shares on the TSXV, the prospective geology and composition of its properties, anticipated results of further exploration on its properties, statements relating to the YESAB litigation, or other similar expressions and all statements, other than statements of historical fact included herein. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, the following risks: the need for additional financing; the satisfaction of the conditions imposed by the TSXV on the Listing; operational risks associated with mineral exploration; regulatory risks; fluctuations in commodity prices; title matters; litigation risks; and the additional risks identified in the Company’s long form prospectus dated October 25, 2024 filed under its issuer profile on SEDAR+ and other reports and filings with the TSXV and applicable Canadian securities regulators. Forward-Looking statements are made based on management’s beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws. Investors are cautioned against attributing undue certainty to forward-looking statements.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/230387

News Provided by Newsfile via QuoteMedia